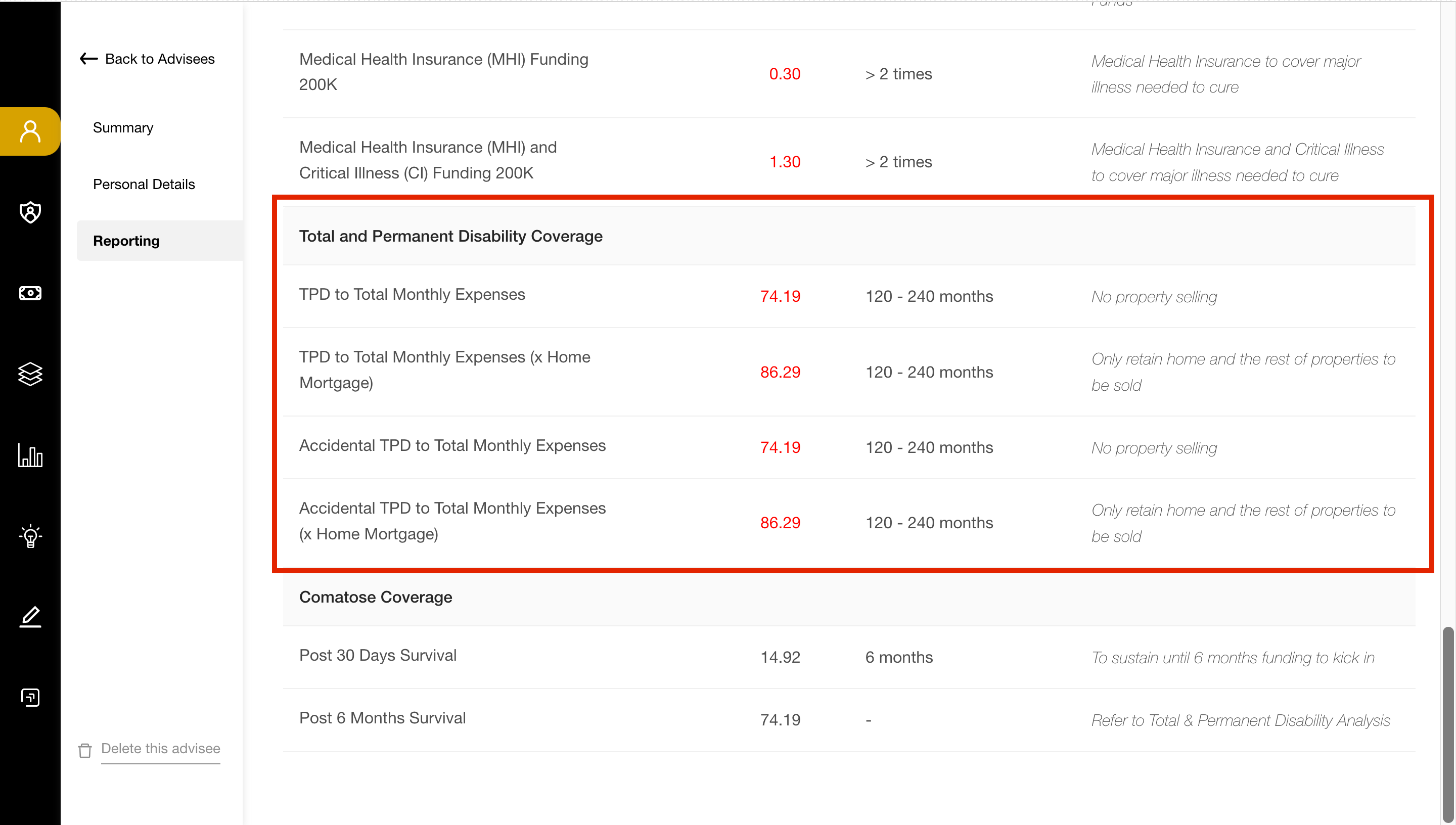

Explaining Total and Permanent Disability Coverage

Risk Ratio

There are 5 segments in the Risk Ratio that you would need to understand. Each segment provide different insights on different situation that may happen and how their current Insurance Portfolio will be able to help them.

Understanding each line is crucial to help your client in building their Financial protection.

Here we will go through the items in Total and Permanent Disability Coverage :

- TPD to Total Monthly Expenses

– When Insured suffered TPD, the total TPD cover will be paid out to the insured as his/her income replacement to sustain his usual Expenses (as per in cash outflow)

– the cover paid will be used to clear ALL Outstanding Loan Balance, the balance amount can be used to sustain the beneficiary for N month (calculated with continuous compounding future value with the adjusted interest rate)

- TPD to Total Monthly Expenses (x Home Mortgage)

– When Insured suffered TPD, the total TPD cover will be paid out to the insured as his/her income replacement to sustain his usual Expenses (as per in cash outflow)

– the cover paid will be used to clear ONLY Mortgage for Own Usage’s Outstanding Loan Balance, the balance amount can be used to sustain the beneficiary for N month (calculated with continuous compounding future value with the adjusted interest rate) - Accidental TPD to Total Monthly Expenses

– When Insured suffered TPD, the total TPD + Personal Accident + Accidental TPD cover will be paid out to the insured as his/her income replacement to sustain his usual Expenses (as per in cash outflow)

– the cover paid will be used to clear ALL Outstanding Loan Balance, the balance amount can be used to sustain the beneficiary for N month (calculated with continuous compounding future value with the adjusted interest rate) - Accidental TPD to Total Monthly Expenses (x Home Mortgage)

– When Insured suffered TPD, the total TPD + Personal Accidental + Accidental TPD cover will be paid out to the insured as his/her income replacement to sustain his usual Expenses (as per in cash outflow)

– the cover paid will be used to clear ONLY Mortgage for Own Usage’s Outstanding Loan Balance, the balance amount can be used to sustain the beneficiary for N month (calculated with continuous compounding future value with the adjusted interest rate)