Explaining Natural Death Coverage

Risk Ratio

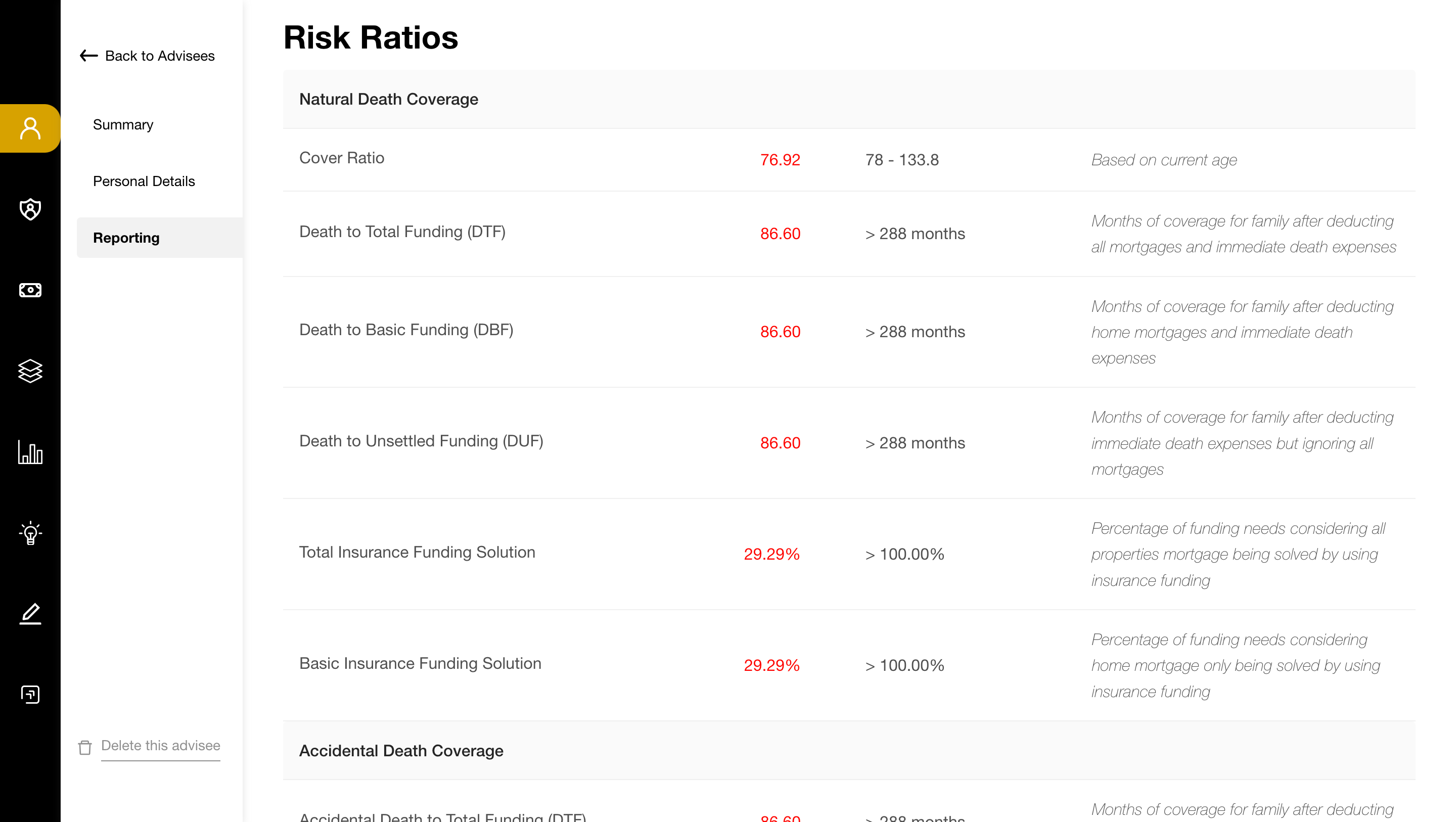

There are 5 segments in the Risk Ratio that you would need to understand. Each segment provide different insights on different situation that may happen and how their current Insurance Portfolio will be able to help them.

Understanding each line is crucial to help your client in building their Financial protection.

Here we will go through the items in Natural Death Coverage:

- Cover Ratio

– Cover Ratio is the multiple that the insurance company is supposed to payout to the insured from the amount of premium he/she paid every year, based on his/her age.

– Cover Ratio = Total Death Cover/Total Premium Per Year

– The Older the insured is, to Lower the Cover Ratio due to higher mortality rate as age increases. - Death to Total Funding (DTF)

– Upon insured death, as the total Death Benefit paid out by the insurance company to the beneficiary (assuming all beneficiary have the same goal),

– the Beneficiary pays off ALL the Outstanding Loan (without MRTA) of the insured

– the balance amount of the Death Benefit can be used to sustain the beneficiary for N month (calculated with continuous compounding future value with the adjusted interest rate) - Death to Basic Funding (DBF)

– Upon insured death, as the total Death Benefit paid out by the insurance company to the beneficiary (assuming all beneficiary have the same goal),

– the Beneficiary pays off ONLY the Outstanding Loan for Mortgage of Own Home (without MRTA) of the insured.

– the balance amount of the Death Benefit can be used to sustain the beneficiary for N month (calculated with continuous compounding future value with the adjusted interest rate) - Death to Unsettled Funding (DUF)

– Upon insured death, as the total Death Benefit paid out by the insurance company to the beneficiary (assuming all beneficiary have the same goal),

– the Beneficiary pays off NONE the Outstanding Loan of the insured.

– the balance amount of the Death Benefit can be used to sustain the beneficiary for N month (calculated with continuous compounding future value with the adjusted interest rate) - Total Insurance Funding Solution (Total IFS)

– Percentage of funding needs considering all properties mortgage being solved by using insurance funding - Basic Insurance Funding Solution (Basic IFS)

– Percentage of funding needs considering home mortgage only being solved by using insurance funding