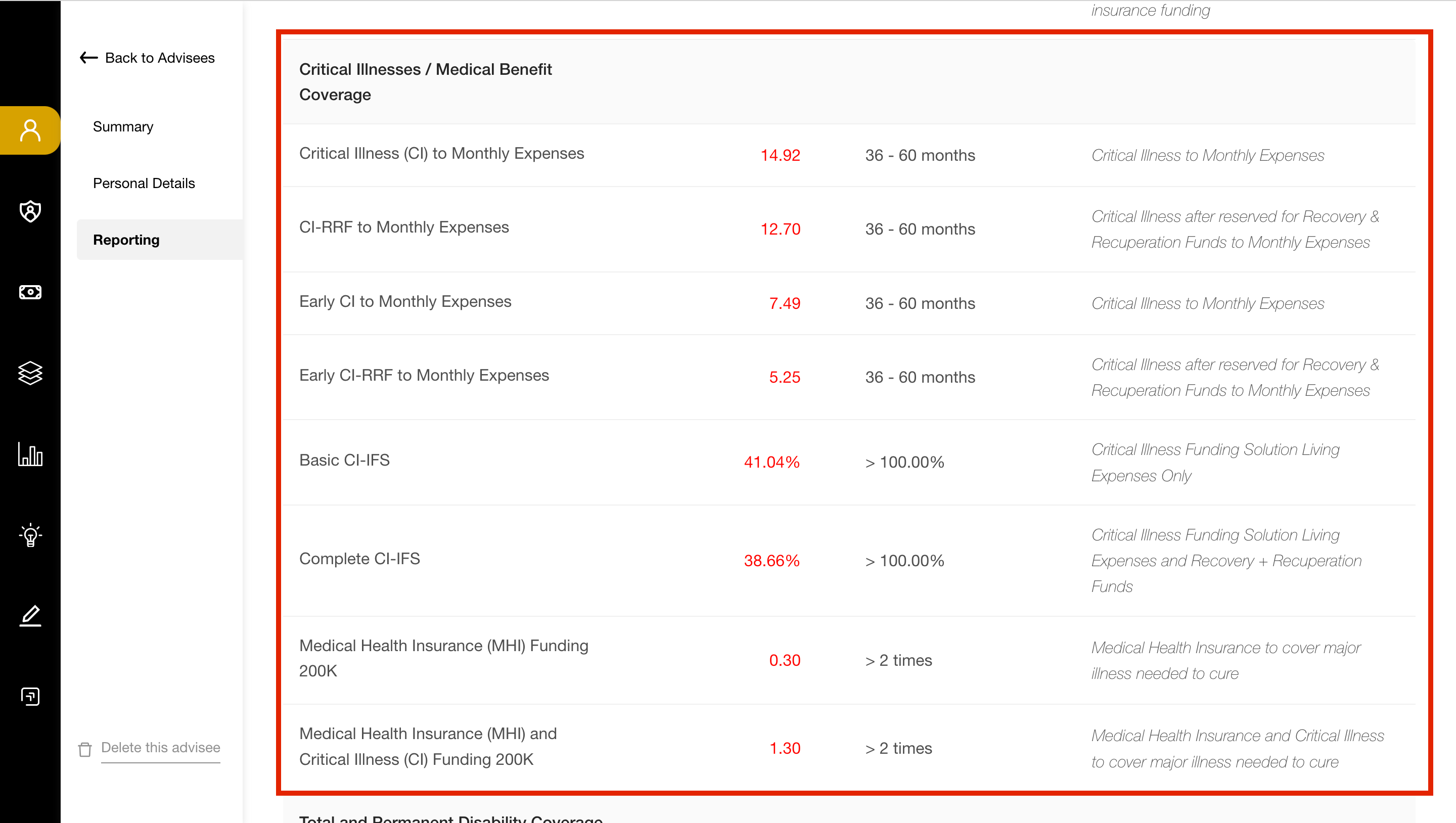

Explaining Critical Illnesses / Medical Benefit Coverage

Risk Ratio

There are 5 segments in the Risk Ratio that you would need to understand. Each segment provide different insights on different situation that may happen and how their current Insurance Portfolio will be able to help them.

Understanding each line is crucial to help your client in building their Financial protection.

Here we will go through the items in Critical Illnesses / Medical Benefit Coverage:

- Critical Illness (CI) to Monthly Expenses

– When Insured down with late stage Critical Illness, the total CI cover will be paid out to the insured as his/her income replacement to sustain his usual Expenses (as per in cash outflow)

– the cover paid can be used to sustain the beneficiary for N month (calculated with continuous compounding future value with the adjusted interest rate) - CI-RRF to Monthly Expenses

– When Insured down with late stage Critical Illness, the total CI cover will be paid out to the insured as his/her income replacement to sustain his usual Expenses (as per in cash outflow)

– taking into account a buffer amount / additional expenses to speed up insured’s recovery, the Recover & Recuperating Fund (RRF)

– RRF amount can be updated in Advisee’s Personal Details

– the cover paid after minus of RRF, the balance can be used to sustain the beneficiary for N month (calculated with continuous compounding future value with the adjusted interest rate) - Early CI to Monthly Expenses

– When Insured down with Critical Illness, the total CI + Early/Total CI cover will be paid out to the insured as his/her income replacement to sustain his usual Expenses (as per in cash outflow)

– the cover paid can be used to sustain the beneficiary for N month (calculated with continuous compounding future value with the adjusted interest rate) - Early CI-RRF to Monthly Expenses

– When Insured down with Critical Illness, the total CI + Early/Total CI cover will be paid out to the insured as his/her income replacement to sustain his usual Expenses (as per in cash outflow)

– taking into account a buffer amount / additional expenses to speed up insured’s recovery, the Recover & Recuperating Fund (RRF)

– RRF amount can be updated in Advisee’s Personal Details

– the cover paid after minus of RRF, the balance can be used to sustain the beneficiary for N month (calculated with continuous compounding future value with the adjusted interest rate) - Basic CI-IFS

– Critical Illness Funding Solution Living Expenses Only

– How many % of insured’s financial problems is covered in the event of CI - Complete CI-IFS

– Critical Illness Funding Solution Living Expenses and Recovery + Recuperation Funds

– How many % of insured’s financial problems is covered in the event of CI - Medical Health Insurance (MHI) Funding

– Medical Health Insurance to cover major illness needed to cure

– the amount (by default 200k) can be adjusted in Advisee’s Personal Details - Medical Health Insurance (MHI) and Critical Illness (CI) Funding

– Medical Health Insurance and Critical Illness to cover major illness needed to cure

– the amount (by default 200k) can be adjusted in Advisee’s Personal Details